Use the filters below to select the topic you need.

All lifetime mortgages we recommend fully meet the Equity Release Council’s product standards and therefore feature a no negative equity guarantee. This means that your estate will never owe more than the property is worth when it is sold, provided it is sold for a reasonable price.

With a lifetime mortgage you continue to own 100% of your home and can remain living in it. The loan is secured against your home, much like a conventional mortgage.

For a home reversion plan you sell part or all of your home to a lender, who will then receive payback from the eventual sale of your home. You have the right to reside in your house if you take out a home reversion plan, subject to meeting lenders terms and conditions.

This will depend on your age and the value of your property. The older you get, the larger percentage of the value you can access. Some lenders also take into account your health and lifestyle to increase the amount you can release.

As an example, a 70-year-old might be able to release up to 41% of their homes value.

We talk through all these factors with you during your no-obligation fact find appointment, before advising you whether or not we think that equity release is your best option.

Yes, you can make monthly repayments or even repay your lifetime mortgage early – however payments are optional on some plans. You can make partial repayments and, subject to certain limits, some plans will allow you to do so without any early repayment charges. Early repayment charges may apply above a certain value.

You can also pay back the loan, plus any interest accrued, in full. However, early repayment charges can be quite high, so ensure you disclose to your adviser if this is likely to happen, as plans with features to minimise or avoid these charges can be considered, depending on the scenario.

Yes, you can. If this is something you’re planning to do in the future, or want to have the option to do, speak to your adviser. It may be that if you’re downsizing, you could have to repay a portion of the plan, if the value of your new home doesn’t match the value of your loan. You will also have to ensure that the new house meets the criteria and standard of the lender, so it’s always best to speak to them first before committing to a new property.

The plan comes to a natural end and the provider gives a 12-month period during which the balance of the loan would need to be repaid. This doesn’t necessarily have to be from the sale of the property as beneficiaries could raise the money to clear the outstanding borrowing from other sources.

Initial advice is free and without obligation.

If you decide to proceed and only when your case completes will a fixed fee of £1,695 be payable.

Solicitors fees – typically £990 in England & Wales.

Some plans include a lenders fee.

Some plans offer cashback.

There could be a valuation fee depending on your preferences and priorities or the size of the loan.

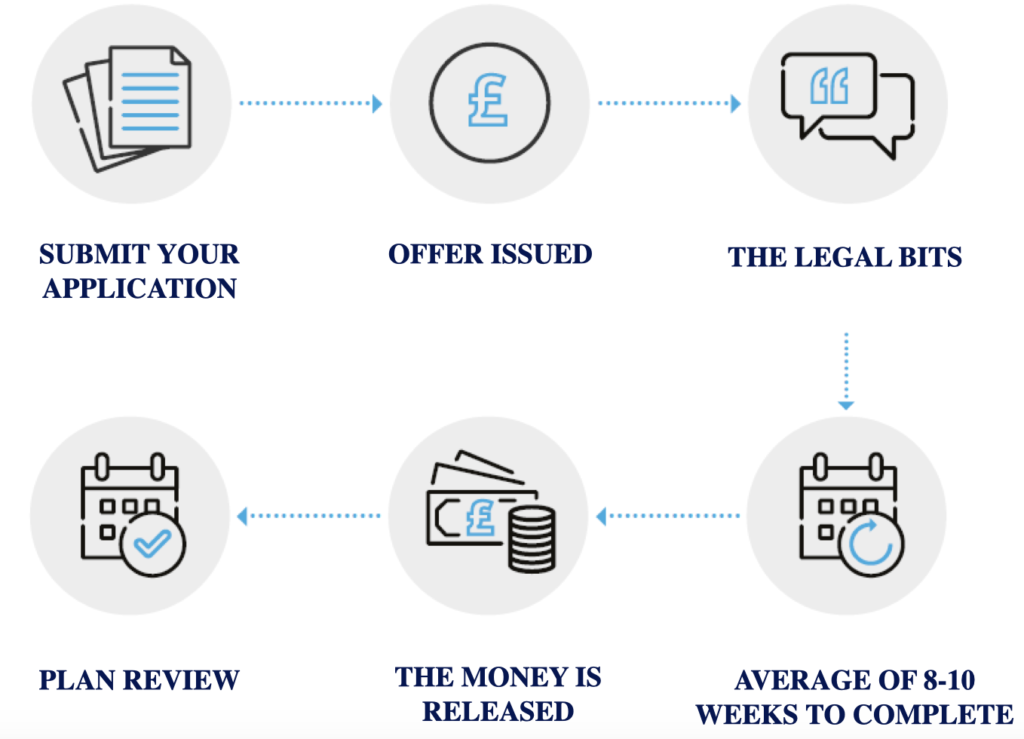

Submit your application: Then your property will be valued by an independent surveyor.

Valuation: Following submission of your application, the lender will appoint their own fully qualified surveyor to carry out a valuation of your property for lending purposes.

Offer issued: You will be issued with an offer from your recommended lender.

The legal bits: You are required to speak with an independent solicitor who will cover the legal aspects.

8-10 weeks to complete: Although a timescale cannot be guaranteed, we’d estimate it takes 8-10 weeks from application to completion.

The money is released: Once your case has completed the monies are released to your nominated account by your chosen solicitor.

Plan review: In a year or so, we can review your plan to make sure it’s still providing you with the best outcome.

Being part of a large equity release advisory group we have extensive knowledge of the marketplace, lenders criteria and advanced sourcing technology to enable us to tailor a plan that provides you with the best outcome based on your circumstances, preferences, and priorities.

our Sterling Equity Release adviser Mark Jackson, has years of experience of helping clients to decide whether equity release is right for them and is a major part of what we do.

This ensures that our clients have the peace of mind that they have all the facts (the upside and the downside of equity release) and have explored all the alternative options that may be available to help them make an informed decision. As one size certainly doesn’t fit-all and everyone’s circumstances are different.

We are fully transparent and record all our conversations to ensure that you are fully protected as part of the advisory process we undertake either over the phone, online or face-to-face. We will confirm any set-up fees involved to put an equity release plan in place, which forms part of our market leading recommendation reports.

Having advised on equity release for many years, Mark Jackson has earned a great reputation for customer service. We don’t treat equity release as a one-off transaction but commit to our clients for the long-term. Ensuring that their plan is still providing them with the best outcome and if not advising them of alternative options that could help them save many thousands of pounds over the estimated lifetime of the plan if the interest rate was more favourable or if it was beneficial in other ways due to recent lender innovations. This is our commitment of being with you every step of the way and ensures you have long-term peace of mind.

Access our useful tools available to for you to help plan your equity release journey.

If you gave a question about Equity Release, how we can help, or you’re ready to plan your next steps. Please get in touch.